What Is Wealth, And What Are We Really Trying to Achieve When We Strive For It?

Jun 02, 2025Early in my career, someone – I don’t recall who – told me that true wealth was the ability to do what you want, when you want, and with the people you want. This definition had a profound impact on me. At the time, I was working as an associate at a large investment bank in New York City and while I was earning a good living, I had none of the freedoms that this definition of “wealthy” envisioned.

To paint the picture, the vice president in charge of staffing deals had explained that the definition of being “fully staffed” was working until 2:00 in the morning six days a week and putting in reasonable hours on the seventh day. Until that was the case, we could not say “no” to being staffed on additional work. While I could certainly afford to do almost whatever I wanted during my vacations (I took up SCUBA diving as a hobby!) I had to schedule those vacations six months out if I didn’t want to risk them being cancelled by more work!

The story was not much different for my wife, who was working for a large Manhattan law firm, namely long hours at work with a schedule entirely at the mercy of the Partners at her firm. We both noticed something astounding to us: The law partners and senior bankers worked hours that were not much less or more flexible than their junior associates. Sure, they could work from home on the weekends – but they still worked!

Law partners and senior bankers may make enormous amounts of money, but are they really wealthy? Does the free time once they retire (maybe retire early?) make up for all of the missed special occasions, school recitals, and children’s sports over the years?

In his book, the Five Types Of Wealth, author and serial entrepreneur Sahil Bloom posits that financial wealth – the kind of wealth that most immediately comes to most of our minds when thinking about wealth, and the kind that high-performing professionals often chase – is just one aspect of true wealth. Bloom goes on to describe five different aspects of wealth that a person can accumulate over a lifetime, including: Time Wealth, Social Wealth, Mental Wealth, Physical Wealth, and, finally, Financial Wealth. Are we really making good decisions when we trade our time, our social connections, our mental health, and our physical wellbeing in the quest for financial rewards?

When reading this article – or Bloom’s book – you may immediately answer, “of course not.” But the data tells a different story. A 2023 study by Empower – a large provider of employer sponsored retirement plans such as 401(k)s – discovered that 59% of Americans believe that money can indeed buy happiness, and 71% believing that “having more money would solve most of my problems.”1

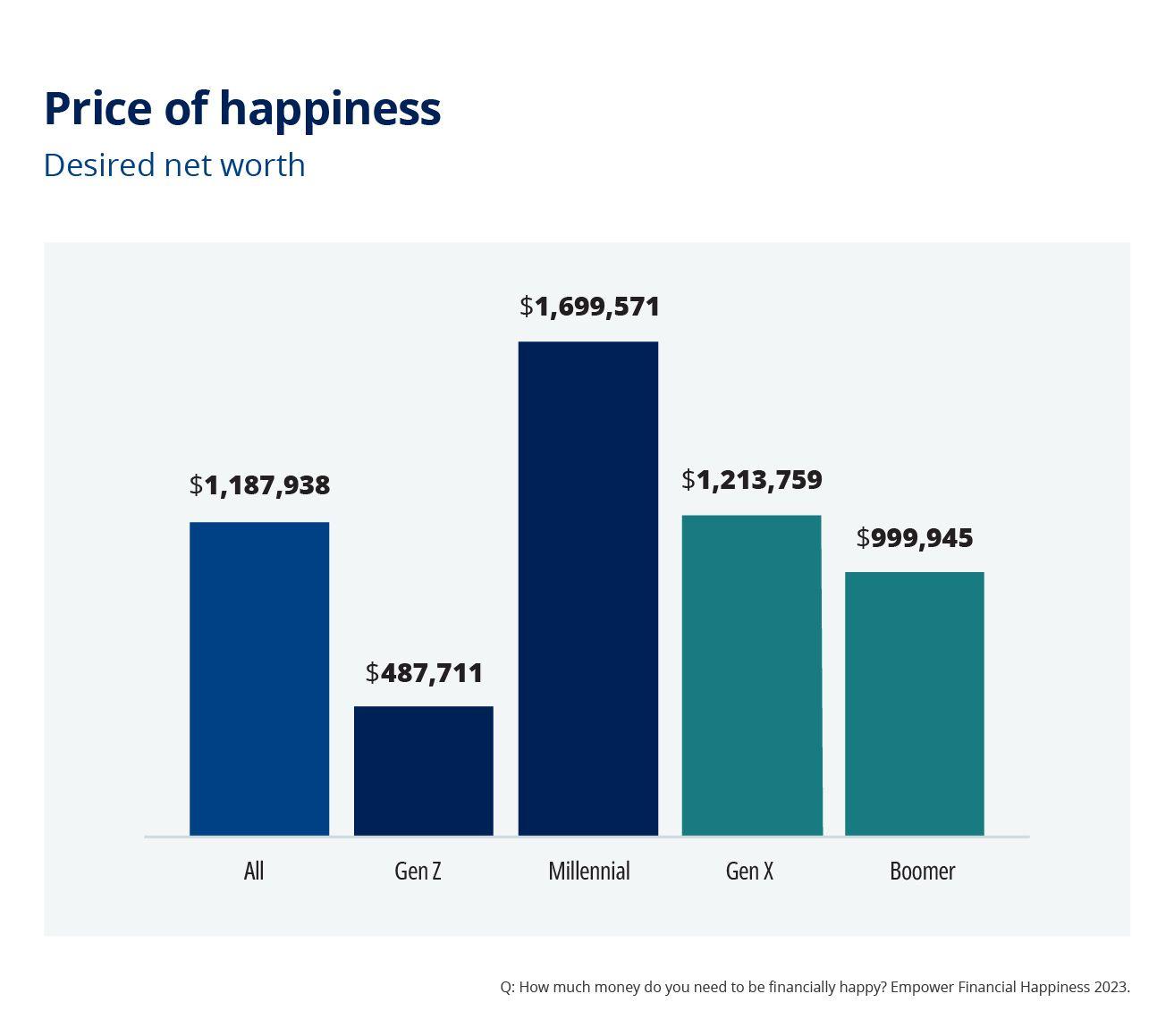

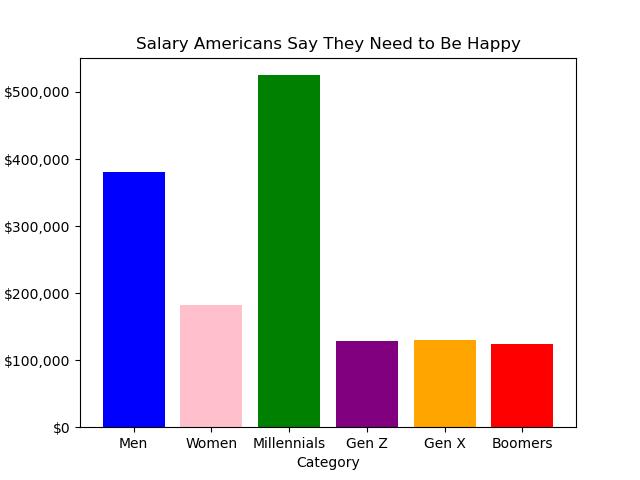

What does having “more money” really entail? According to that same Empower study, it is radically different based upon generation and gender:

(There is a lot to unpack here on how much higher Millennials expectations of financial happiness are than other generations – but I’ll leave that for another column!)

How might we be able to increase our happiness by using our wealth – at whatever level we may have it – in more intelligent and thoughtful ways?

In his Book Die With Zero author Bill Perkins suggests that balancing the need to accumulating assets with the need to have great experiences is the key to achieving real wealth. What is the point of accumulating assets if all we ever do with those assets is revel in having them?

Many academic studies have concluded that people derive more happiness from buying experiences – trips, concerts, vacations – than they do from buying things. An interesting study out of Canada showed that there is also intense value to spending money to reduce unenjoyable experiences. In this study, working adults in Canada derived more happiness from a $40 windfall when they were instructed to use this money to “buy time” (e.g., by paying for grocery delivery or house cleaning) than to buy a material thing.2

More recently, a study recruited 200 volunteers from seven countries including three low-income countries and four high-income countries and gave each of the volunteers a one-time payment of $10,000 with the simple instruction that they had to spend the money in the next three months. The study then analyzed how the participants felt depending on what they did with the money3.

This study found that five kinds of spending tended to offer the most happiness to the participants, namely spending money on:

- Donations to charity

- Experiences

- Personal care

- Education

- Gifts to an individual

Coming in sixth place was spending on durable goods, and spending on clothing was even lower on the list in 8th place.

What can we learn from all of this?

If we can agree that financial wealth is not a goal in-and-of itself, but rather a tool to be used to increase your happiness There’s a number of take aways.

First, once you have “enough” assets and “enough” income (what is “enough” will be the subject of a future article but the study and charts above provide a good starting point), start focusing on accumulating experiences tat make you happy rather than more assets and income.

Second, even if you do not yet have “enough,” start spending your money with intention. Maybe that means redirecting some of your spending away from stuff and more towards experiences or donations, or maybe it means forgoing a purchase in order to hire a gardener or cleaning service for your home in order to avoid a task you dislike. By spending with intention, you may be able to buy more happiness with your limited dollars.

And by increasing your happiness, you may just find that you don’t actually need all of the financial wealth you once strove for, giving you even more time to focus on the happiness you have.

--------------------------------------------------------

1The price of financial happiness? $1.2 million | Empower

2Whillans, A. V., Dunn, E. W., Smeets, P., Bekkers, R. & Norton, M. I. Buying time promotes happiness. Proc. Natl. Acad. Sci. USA. 114, 8523–8527 (2017).

3How spending decisions shape happiness in everyday life | Communications Psychology